Guides Library

6 Options for a Distribution from a Company Plan

Many people have company-sponsored retirement plans as part of their portfolios. There are significant tax-saving strategies that may only be available at the time of accessing your funds, so proceed with caution to avoid missing key savings opportunities and triggering costly tax surprises.

Avoiding Charitable IRA Beneficiary Mistakes + Bonus New Gifting Strategy

Designating a nonprofit organization or charity as a beneficiary of your estate is admirable. However, although their tax-exempt status makes IRAs ideal for charitable gifting, some complexities may arise during estate administration.

Avoiding Double Taxes on Your Inheritance

When inheriting a loved one’s retirement assets, estate beneficiaries are often subject to a heavy tax burden. If the estate is subject to both federal estate and income taxes, consider the income in respect of a decedent (IRD) deduction to avoid double taxation.

Fixing Rollover Mistakes with Self-Certification

If you missed the 60-day deadline for completing an IRA rollover due to an error or an unexpected life circumstance, the IRS has an option for individuals to self-certify for a waiver of the deadline so that they can complete a late rollover.

How (and Why) to Decline an Inheritance.

Although declining an inheritance seems like an unlikely move, there are situations in which a beneficiary chooses to pass their assets to an alternate beneficiary, whether the inheritance may trigger undesirable tax or estate complications, affect the heir’s ability to qualify for certain federal benefits or any other life circumstance.

Planning for Multiple Beneficiaries

When creating a financial plan, many people wish to leave a legacy for their loved ones. Some individuals choose to name their spouse as the sole beneficiary, while others have a list of loved ones they wish to include. If you intend to leave assets to multiple people, having them listed properly as beneficiaries is essential.

A 529 plan or a Roth IRA. 529 plans are a well-known option designed specifically for this purpose. Distributions from a 529 plan can be used to cover the cost of attendance at a public.

Have unused funds in a 529 you’d like to move to a Roth? There are new options available now under SECURE 2.0, but some limits and fine print to navigate. Let’s discuss if this is of interest!

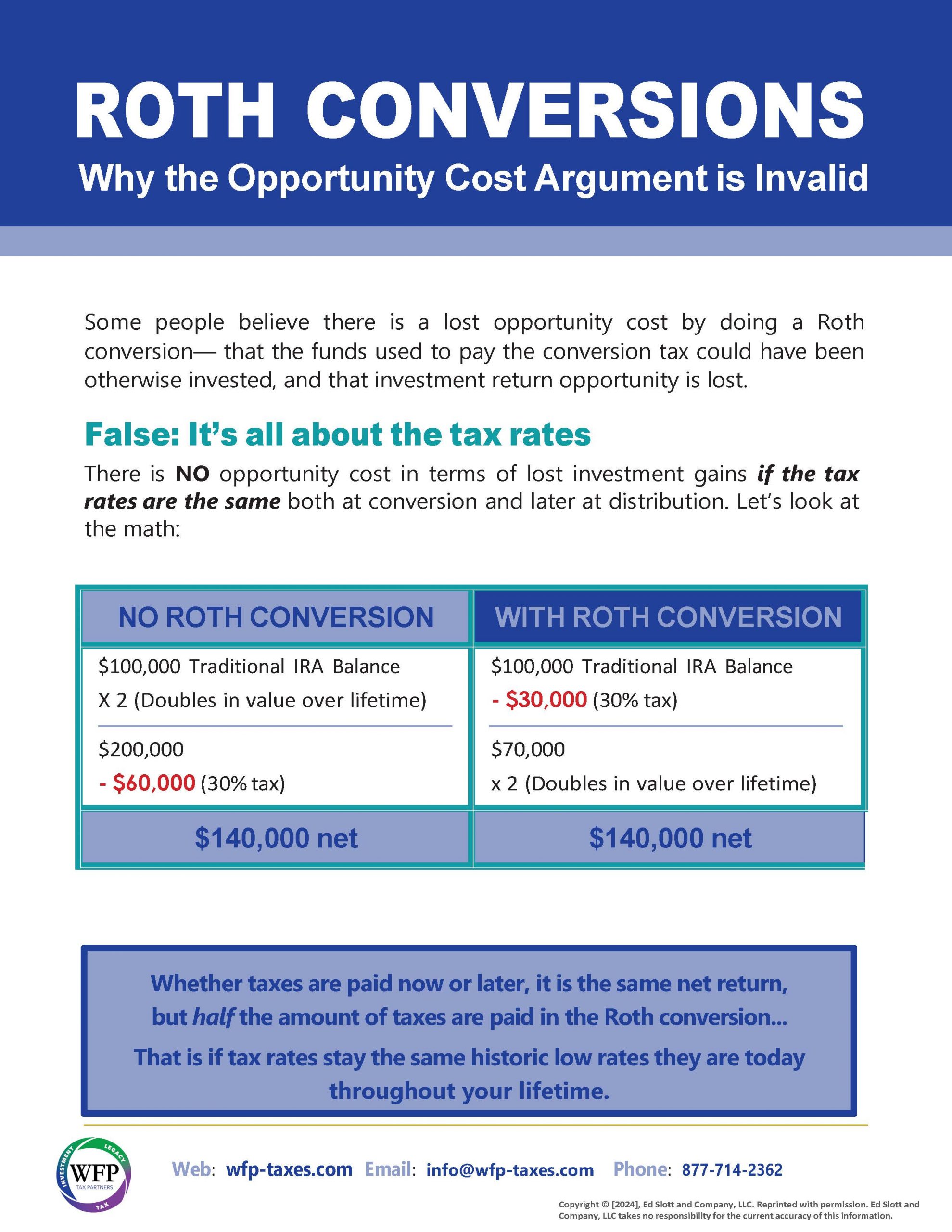

Roth Conversions – Dispelling the Opportunity Cost Argument

The opportunity cost argument surrounding Roth conversions suggests that an opportunity is lost by paying the conversion tax upfront instead of investing it. There is no opportunity cost in terms of lost investment gains if the tax rates are the same at conversion and later at distribution.